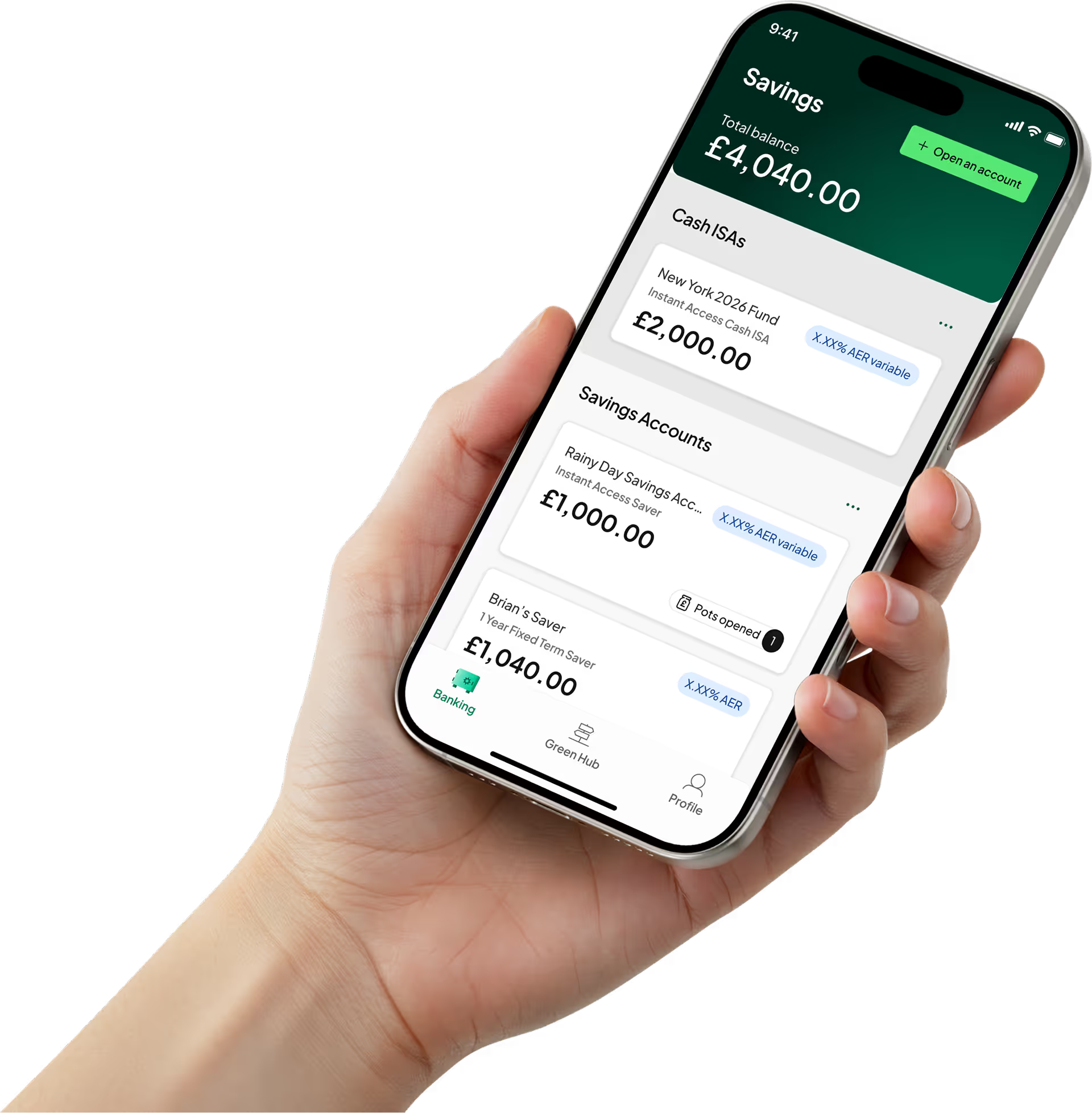

Saving for something special?

Whether it’s your next trip or a rainy-day buffer, stash your cash in dedicated pots and watch it grow.

Save when you like, take it out when you need.

Already used your tax-free allowance in an ISA? Compare our flexible Instant Access Saver account next to our Fixed Term Saver accounts.

AER stands for Annual Equivalent Rate and illustrates what the interest rate would be if interest was paid and compounded each year. This allows you to compare what return you can expect from your savings over time. Tax-free means interest is exempt from UK Income Tax under current HMRC ISA rules. Tax treatment depends on individual circumstances and may change in the future.

Earn up to

4.10

% AER tax-free.

With our Instant Access Saver, you’re in full control. You choose when, how much and how often you save, with full access to your money if you need it.

Have quick access to your money with unlimited deposits and withdrawals.

Add as little or as much as you like, up to £250,000.

Earn interest daily, paid into your account monthly.

The rate can go up or down but if its going down we will always give you a heads up first.

AER stands for Annual Equivalent Rate and illustrates what the interest rate would be if interest was paid and compounded each year. This allows you to compare what return you can expect from your savings over time.

We’re a fully regulated UK bank so you can rest easy knowing that your money is protected, up to £120,000 by the Financial Services Compensation Scheme (FSCS), the UK’s deposit guarantee scheme.

%201.avif)

We’ve got answers! Explore our most common savings questions, or head to our full FAQ page to find more.

At the moment, you can only have one regular transfer in place.

You can easily cancel and set up a new regular transfer within the Tandem app. Just head to your Instant Access Saver account and tap on your regular transfer to find your options.

Regular transfers let you automate moving money from your external UK current account into your Tandem Instant Access Saver. Just set up how often you want money transferred – daily, weekly, fortnightly or monthly. This way, you steadily build up your savings without even thinking about it!

To set up a regular transfer, open the Tandem and go to your Instant Access Saver account. Tap ‘Set up a regular transfer’ and follow the steps to get started.

There's no limit to the number of savings pots you can create.

Your primary pot serves as your default or main savings hub, typically used for general savings. It's where transfers can be made between your verified external UK current account and your Tandem account.

Additional pots, on the other hand, can be created for specific goals, making it easier for you to keep track of all your savings goals in your one account.

Savings pots within your Instant Access Savings account let you divide your savings for different goals, all earning interest collectively. Whether your money is in your primary pot or distributed across additional pots, the interest applies to your entire balance. It's like having multiple compartments for your goals, while ensuring all your savings work together to grow with the same interest rate.

We are only able to accept money transferred from a verified UK bank account. This provides fraud protection for both Tandem and you.

No, you can only hold a single Instant Access Saver account. However, within this account, you can create multiple 'pots' to divide your savings for various goals, whilst still earning interest collectively.

Simply open the app, tap on your Instant Access Saver account and then select the‘Info’ icon to access your account details.

No, we can only accept money from a bank account that we have verified as belonging to you. We will return any money sent from accounts that haven’t been verified.

If you wish to transfer funds from a different account, select ‘Connect a new current account’ through the ‘Pay in via Open Banking’ screen in the app. Once we’ve verified this new account, you can then transfer money in and out of it.

If you need more assistance with connecting another account, feel free to use our in-app chat or call 0203 370 0970 and we’d be happy to help.

Your interest will calculate up until the point you remove the funds and will apply on to the account on the anniversary of the date you first funded it.

Interest is calculated daily and compounded into your Instant Access Saver on a monthly basis. The interest will be applied to your account each month on the same date you first funded it. You’ll receive an SMS when your interest has been added and your statement is ready to view in the app.

Check out our FAQs for answers to your burning questions, or give our friendly support teams a shout.

Available on both the App Store and Google Play.

Open an account and start saving in seconds.