Fixed Rate Cash ISA Maturity

Your savings, your choice. As your Fixed Rate Cash ISA approaches the end of its term (what we call the “unlock” date), here’s everything you need to know — including how and when to tell us what you’d like to do next. — an extra ISA allowance based on the value of their ISAs when they passed away. This means you could add more money to your own ISA without affecting your standard annual ISA limit — helping you keep more of your savings tax-free at a difficult time.

What does it mean when my ISA “unlocks”?

Your ISA “unlock” date is the same as your maturity date — it’s the end of your fixed term. On that date, your Fixed Rate Cash ISA stops earning interest at its fixed rate.

But you don’t need to wait until then to make a decision. You’ll get a 14-day maturity window before your unlock date to choose what to do with your funds.

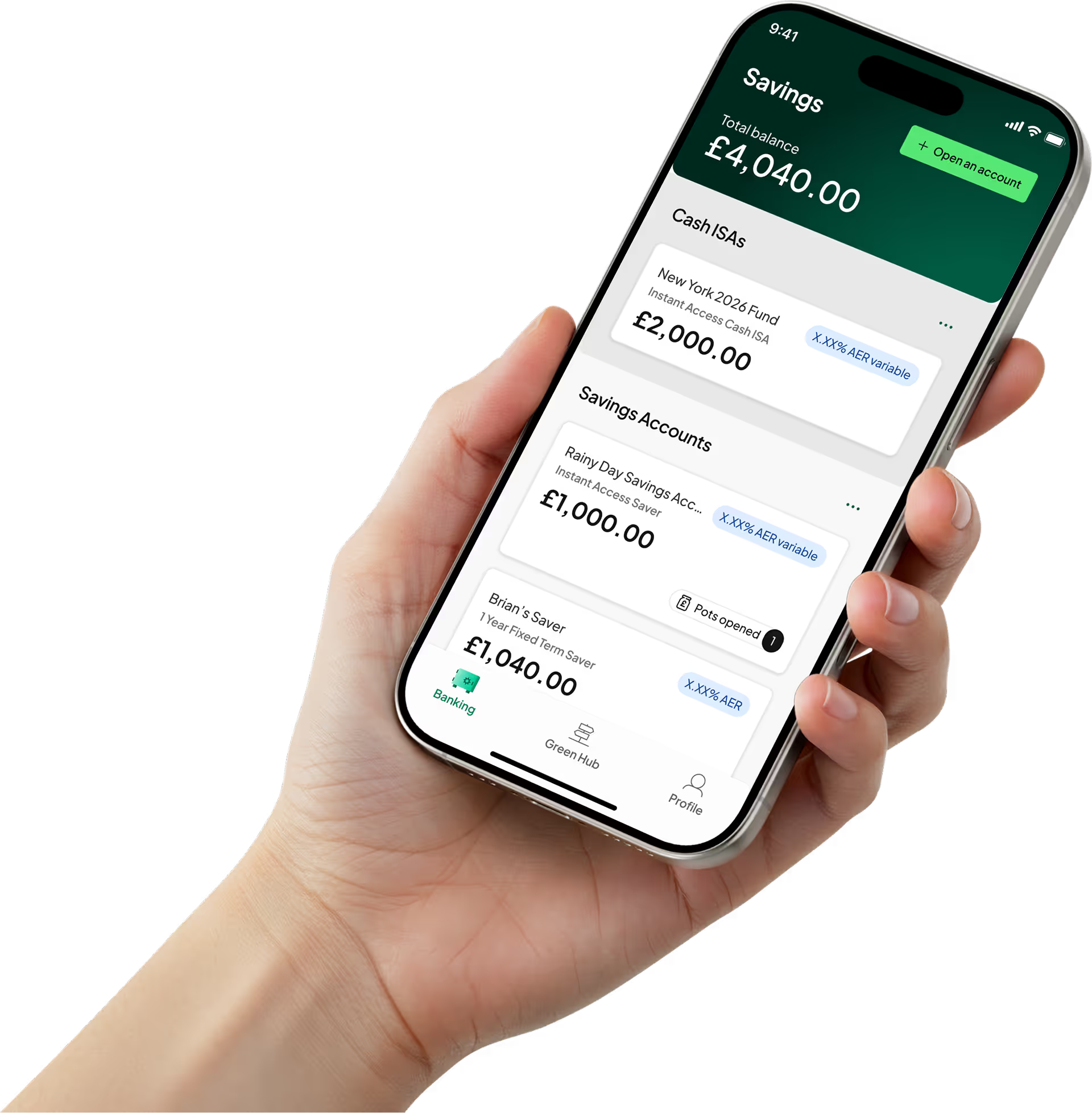

In the app, this date will be shown as your account’s “unlock” date.

What can I do with my money when it unlocks?

During your 14-day maturity window, you can choose one of the following options for your matured funds:

⚠️ Withdrawn funds will no longer be in an ISA and will lose their tax-free status. You’ll only be able to reinvest them if you have ISA allowance available.

⚠️ If we don’t receive your instructions during the maturity window, your funds will automatically move into a default Instant Access Cash ISA so they keep earning interest.

When do I need to decide?

We’ll keep you informed in the run-up to your unlock date. Here's what to expect:

- 14 days before unlock: We’ll email you to let you know your options are available in the app.

- 5 days before unlock: We’ll send a reminder if we haven’t heard from you.

- On your unlock date: We’ll follow your instructions or move your funds into a Matured Funds Cash ISA if no action is taken.

What happens if I don’t do anything?

If we don’t hear from you during the 14-day window, your balance will move into a Matured Funds Cash ISA, which:

- Earns a variable interest rate (shown in the app)

- Doesn’t allow new deposits

- Allows withdrawals of the full balance only

Your funds will stay tax-free, but the interest rate may not be the best available — so it’s worth reviewing your options ahead of your unlock date.

When will I get confirmation?

Once your account unlocks, we’ll send confirmation of:

- Any new Fixed Rate or Instant Access Cash ISAs you’ve opened

- The withdrawal if you’ve requested one

- The transfer, if arranged via a new provider

Got questions?

We’re here to help. Reach out to our Customer Support team if you’re unsure what to do, want to talk through your options, or have a specific request for how you'd like your funds split.

Ready to make your money do more?

Can't find what you're after?

Check out our FAQs for answers to your burning questions, or give our friendly support teams a shout.